Few car problems are as devastating as a damaged engine, especially when you are aware that repairs can be anywhere between $10,000 to $4,000 depending on the type of vehicle. So, the most common question all drivers have to ask is: does auto insurance will cover the cost of a damaged engine?

The quick answer is occasionally, although not necessarily. It depends entirely on the cause of your engine’s failure, and what kind of protection you’ve got..

In this article you’ll find out exactly what insurance covers a damaged engine, and when it won’t or will not, as well as what alternatives you’ve got if you’re faced with a major repair bill. The guide is written in a straightforward approach that’s real-world in order to aid all drivers, novice car owners, and those not a car expert understand their most effective next steps.

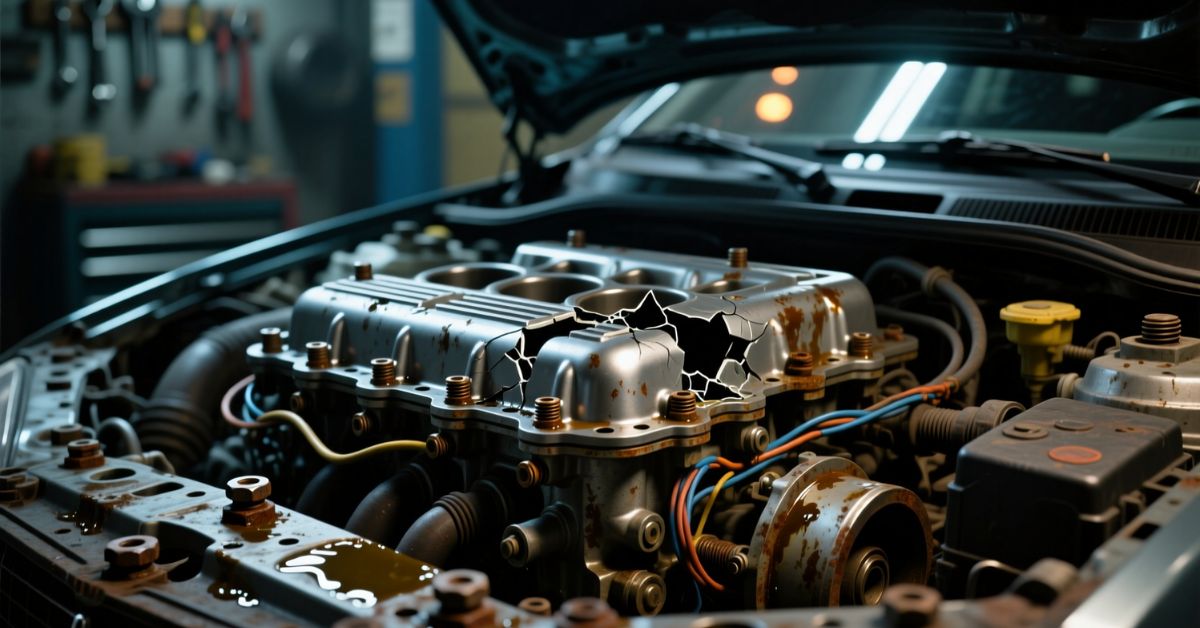

Does Auto Insurance Cover a Blown Engine?

The majority of people think insurance covers every major repair to a car. However, the situation with engine failure is distinct.

Insurance protects the engine in the event of a blowout, but only in the event that:

- The damage to the engine was the result of an unreported accident

- A specific incident affected it (flood or theft, fire and falling objects)

- The accident occurred due to the negligence of a driver

Insurance will not provide coverage for a damaged engine if:

- The reason for this was the wear and tear

- You didn’t notice oil changes

- It was the result of inadequate maintenance

- A high mileage engine has led to failure

- You’ve overheated the engine.

- The car was unable to get coolant or oil.

- Mechanical breakdowns occurred naturally in the course of

Insurance companies consider engine failures like other mechanical issues -except that there is a direct related to a peril covered by insurance.

When Auto Insurance Does Cover a Blown Engine

The keyword that is the primary one appears naturally in this case.

1. Collision Coverage

Collision insurance helps in the event that an accident results in the engine blowing up..

For example,

A pedestrian is struck by the guardrail and the radiator breaks, engine overheats and is damaged.

In this instance, collision insurance would normally cover repairs or a complete engine replacement.

2. Comprehensive Coverage

Comprehensive insurance shields your engine from collision-related events for example:

- Floods

- Fires

- Trees are falling

- Vandalism or theft

- Animal injury (e.g. rats chewing wires, deer impacts)

Example:

A flood causes damage to your engine that is beyond repair Then the comprehensive insurance coverage will pay.

3. At-Fault Driver’s Liability Insurance

If a driver was the cause of the accident that caused an engine malfunction, their insurance is accountable.

An example:

Another driver rear-ends you and internal engine components fail The engine then blows up days afterward.

Their liability policy covers the repair costs.

4. Manufacturer Defects

It’s not technically “auto insurance” but it is important.

If your vehicle is in:

- Warranty provided by the manufacturer

- Extended warranty

- Warranty on the powertrain

There are many problems with engines that will be covered, especially when they are caused by defective components.

When Auto Insurance Does Not Cover a Blown Engine

This is when the majority of motorists are taken by the surprise.

1. Normal Wear & Tear

Engines eventually fail because of wear and tear. Insurance sees this as the responsibility of the owner.

- Old gaskets

- Worn pistons

- High-mileage breakdown

- Failing timing belt

All of them are not included.

2. Poor Maintenance

Insurance companies frequently examine maintenance records. Common denied claims include:

- Avoiding oil changes

- Making use of the incorrect oil

- Driving while leaky

- Ignoring dashboard warnings

- Overheating episodes

When negligence led to the engine to stop or explode, the insurance company will not be able to cover it immediately.

3. Running the Engine Without Oil or Coolant

This is among the most frequently cited reasons for a engine to fail that is not covered.

4. Mechanical or Electrical Failure

This includes:

- Broken water pump

- Spark plugs that aren’t working properly

- Timing chain failure

- Sensors malfunction

- Turbo failure

If they are not tied to an event covered by insurance or covered event, these are expenses that are not covered by insurance.

What About Mechanical Breakdown Insurance (MBI)?

Mechanical Breakdown Insurance (MBI) is an optional insurance offered by a few insurance companies like GEICO or Allstate.

This functions similarly to a warranty extension and could protect a damaged engine in the event of a mechanical failure. caused by mechanical malfunction.

MBI generally includes:

- Engine

- Transmission

- Drive systems

- Electrical components

However, it isn’t able to provide:

- Wear and tear

- Neglect

- Overheating

- Maintenance issues

It is perfect in the case of drivers from:

- New automobiles

- Low-mileage vehicles

- Cars that are not covered by warranty by the manufacturer, but are in good shape

Cost Breakdown: How Much Does a Blown Engine Repair Cost?

Understanding the costs can help readers determine whether the value of optional coverage is worth it.

Average engine replacement costs:

- 4-cylinder: $4,000-$5,500

- V6: $5,500-$7,500

- V8: $7,000-$12,000+

- Luxury/European models: $10,000-$20,000

A repair may cost less however, only if the engine can be repairable.

This is the reason why a lot of drivers are interested in knowing whether auto insurance covers the cost of a damaged engine prior to an expense this big.

Actual-World Examples: Insurance Payed in contrast to. It Didn’t

Example 1 – Covered

A driver crashes into a large pothole. The impact damages the oil pan, and the engine breaks down just a few minutes later.

– Collision insurance pays.

Example 2 – Not Covered

A driver isn’t paying attention to a leaky radiator for a few weeks. The engine heats up and explodes.

– Denied because of inadequate maintenance.

Example 3 – Covered

The flash flood fuels up the engine with liquid.

– Comprehensive will pay for the repair.

Example 4 – Not Covered

Timing belts snap around 110,000 miles.

– Mechanical wear is not covered.

How to Protect Yourself From a Blown Engine Financial Disaster

1. Keep Up With Maintenance

Coolant tests, oil changes and responding to dashboard alerts can significantly lower the risk of engine failure.

2. Consider Mechanical Breakdown Insurance

Particularly if your vehicle:

- Are you younger than 5 years old?

- Has under 75,000 miles

- There is no longer an official powertrain warranty.

3. Maintain Documentation

Receipts as well as service history can be helpful when insurance companies try to charge you for inattention.

4. Respond Immediately to Any Warning Sign

The early repairs can help prevent the possibility of devastating engine damage.

5. Understand Your Coverage Before You Need It

Many motorists believe that they’re safe until a $9,000 repair cost shows otherwise.

Conclusion: Does Auto Insurance Cover a Blown Engine?

Most of the time, auto insurance does not cover a damaged engine -except if the damage was directly caused by an accident covered or other event. Wear and tear, negligence or mechanical breakdowns are generally not covered.

The smartest thing you can do as a driver is:

- Be aware of what your current insurance policy covers and doesn’t.

- Keep your vehicle maintained

- Think about MBI and an extended guarantee if your vehicle is more recent.

A damaged engine is costly If you have the right information (and the proper coverage) you can minimize the financial impact.

FAQ’s

1. Can auto insurance be used to protect a damaged engine due to overheating?

In general, there is generally, there isn’t. Overheating is regarded as an issue with maintenance, in the event that it is caused by an incident that was covered.

2. Can insurance cover the cost of replacing an engine following a crash?

Yes, if the engine damage was the direct result of the collision.

3. Does complete insurance cover engine failure?

If the malfunction was the result of the covered risk, like vandalism, fire, flood or even animals.

4. What can I do to cover a blow-out engine in my insurance?

You are able to make a claim but it can only be accepted when the reason matches the covered events.

Disclaimer:

The content on Gap Insurance Guide is for informational and educational purposes only and is not legal, financial, or insurance advice. While we strive for accuracy and reference trusted sources and news websites, we make no guarantees about the completeness or reliability of the information. Insurance laws and policies vary by state, and individual circumstances differ. Always consult a licensed professional before making decisions. By using this site, you agree that Gap Insurance Guide is not responsible for any actions taken based on this content.