Introduction

The purchase of a house is among the largest financial decisions that homeowners take on. But, many homeowners do not consider an important safety measure: gap insurance for homes. Although standard homeowners insurance protects against the most common risks, like theft or fire however, it might not cover you in the event that your home’s market value declines or there are gaps in coverage. In the absence of gap insurance you may encounter unexpected expenses out of pocket while paying mortgages or making an insurance claim.

In this article we’ll go over the details of what gap insurance for houses is, who requires it and how it functions. Additionally, you’ll learn strategies to ensure your investment in a home is fully protected and gives you peace of mind in the uncertain market for housing.

What is Gap Insurance for Homes?

gap insurance on houses is a kind of protection designed to fill that “gap” between your mortgage balance and actual insurance payout in certain situations. In contrast to traditional homeowners insurance, which covers damages or loss, gap insurance will ensure that you don’t have to pay the cost of repairs if your home declines faster than anticipated or if the existing insurance doesn’t cover all replacement cost.

Key points:

- It covers the difference between the mortgage balance and the insurance payment

- Protects homeowners against unexpected market fluctuations

- Provides an additional security protection for newly-homeowners or people with a mortgage that is high.

How Gap Insurance for Homes Works

Gap insurance can be extremely useful in certain circumstances:

- Property Depreciation In the event that your property is worth less due to changes in the market or similar developments Your standard insurance might not be able to cover the entire amount due to your mortgage. Gap insurance helps bridge the financial gap.

- Replacement Cost as compared to. Market Value Standard policies can only cover the the cash value (ACV) that you have paid for the house which includes depreciation. Gap insurance may cover the difference, to meet the cost of replacement.

- Mortgage Requirements Some lenders may require gap insurance in high risk loan scenarios to ensure that their investment is secured.

Examples:

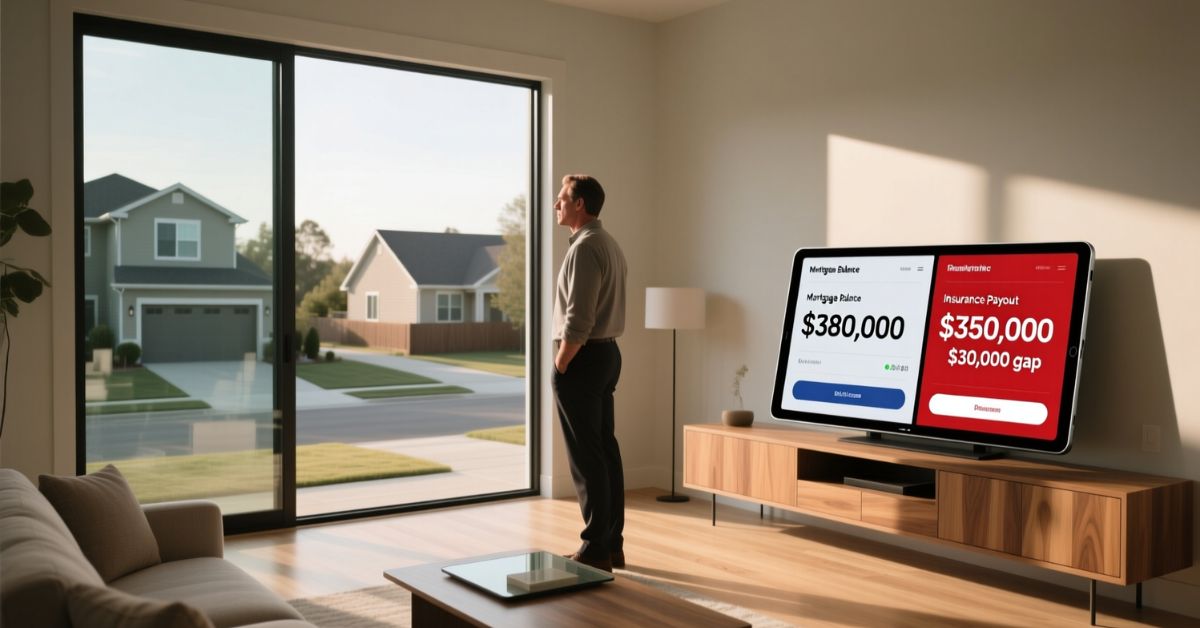

Imagine you purchased a house for $400,000, but you owe $380,000 on your mortgage. If you suffer a loss your insurance payout would be $350,000. In the absence of gap insurance you’d be liable for the difference of $30,000. Gap insurance takes care of it.

Who Needs Gap Insurance for Homes?

Insurance for gaps isn’t required for all homeowners, but certain circumstances make it useful:

- First-time homebuyers with a limited equity

- High loan-to value mortgages (LTV > 80 %))

- Buildings in new construction where depreciation can be substantial in the first few years

- Homeowners who are in the volatile real estate market

If you are in one of the above groups, gap insurance is a great way to stop financial strain and protect your investment.

Benefits of Gap Insurance

- Finance: Avoid paying out-of-pocket to cover the difference between mortgage and insurance balances.

- peace of mind: Gives you peace of mind in unanticipated changes in the market or natural catastrophes.

- Supplemental Protection: Works alongside standard homeowners insurance for greater security.

- Lender Confidence Provides a an ethical risk management approach for mortgage lenders.

Cost of Gap Insurance for Homes

The cost of insurance for gap is contingent on a variety of factors:

- Mortgage balance and home value

- Risk factors and location (flood zones and crime rates, etc.)

- Limitations on coverage and deductible choices

On average, homeowners could expect to pay $200 and $500 annually but costs will vary greatly. Think about the gap insurance as a tiny expense compared to tens of thousands in uninsured losses.

Tips for Choosing Gap Insurance

- Check your mortgage-to-value ratio As close as your mortgage is to the home’s value, the more crucial gap insurance will be.

- Compare insurance companies: Look for companies that have transparent policies, positive reviews, and premiums that are competitive.

- Know limitations: Some policies may not be able to cover certain natural disasters as well as personal possessions.

- Bundle of homeowners insurance with HTML0: Certain providers provide discounts when you combine gap coverage with your existing insurance policies.

Conclusion

Homeowners who have gap insurance are an ideal option to homeowners who need complete financial security. It guards against any gaps in the mortgage balance and the insurance payout which gives you the assurance the investment you have made is protected regardless of unexpected events that occur. Although it’s not mandatory it is particularly beneficial for first-time homeowners, homes with high LTV mortgages, and for properties with volatile market.

If you know the options for your coverage by comparing policies and taking into account the financial circumstances of your family, you are able to select a gap insurance policy that gives peace of mind and doesn’t break your budget. Make sure you protect your home, one of your largest investment options — by getting the appropriate gap insurance today.

FAQ’s

1. Does gap insurance for home owners similar to homeowners insurance?

No. homeowners insurance covers damage from theft, fire or other disasters. In contrast, gap insurance is the coverage for any difference in your mortgage and the insurance payment.

2. What is the gap insurance costs for a typical house?

Premiums generally vary from $200 to 500 per calendar year based on the home’s value, area, and insurance limits.

3. Do I need to purchase gap insurance once I’ve bought my house?

Yes, but it’s the best when it’s purchased earlier particularly for homeowners who are new with mortgages that have a high loan-to-value.

4. Can gap insurance be used to cover natural catastrophes?

It is contingent on your policy. Gap insurance is usually a supplement to your homeowners policy that you have already purchased and therefore coverage for natural disasters is governed by your policy’s main rules.

5. Do lenders need gap insurance?

Not always, however some lenders might suggest or demand it in high-risk mortgages to safeguard their investment.

Disclaimer :

The content on Gap Insurance Guide is for informational and educational purposes only and is not legal, financial, or insurance advice. While we strive for accuracy and reference trusted sources and news websites, we make no guarantees about the completeness or reliability of the information. Insurance laws and policies vary by state, and individual circumstances differ. Always consult a licensed professional before making decisions. By using this site, you agree that Gap Insurance Guide is not responsible for any actions taken based on this content.